Title Company FAQ's

WHAT IS A TITLE COMPANY?

Title companies conduct "title searches" looking at real estate records trying to find information about the property you are trying to purchase. Such information includes:

- Identifying the legal owner of the property

- Liens

- Judgments

- Unpaid taxes

After the search is complete, the title company will complete a "commitment of title insurance" on behalf of either the lender or the buyer. This step ensures the buyer is receiving a clear title on the property and any outstanding issues are resolved. Once these steps are done, the title company will use their underwriter to issue a policy of title insurance covering the lender and the buyer.

CAN A TITLE COMPANY CONDUCT ESCROW?

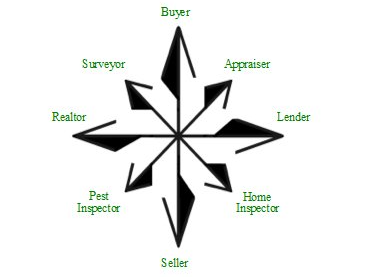

A title company can generally acts as an escrow agent. They can explain all the costs involved for both parties, secure the lender, and prepare a closing statement. The title company will then collect money from both buyer and seller, signed documents, and approval given by lender. The lender wires money to the title company to pay all the expenses, any mortgages, and the seller their proceeds.

WHAT IS A CLOSING ATTORNEY?

A closing attorney represents either the buyer or the seller in a real estate transaction. One attorney can’t do both. They are available to review the documents and protect you from potential mistakes in the closing process.

WHAT IS THE DIFFERENCE BETWEEN A TITLE COMPANY AND A CLOSING ATTORNEY?

There is a bit of overlap between the title company and closing attorney responsibilities. Both can conduct title research and file paperwork on your behalf. However, only the title company issues the insurance. The closing attorney reviews all the documents associated with the deal, will help you look for fees to eliminate, and point out any additional liabilities. Title companies have attorneys on hand, but they are there to answer and solve issues related only to the title search and insurance. They can not guide you and give you feedback about the purchase of the house.

WHAT IS A TITLE?

A title is a right to ownership of specific real estate property. Included is the right of possession, right of exclusion, right of control, the right of enjoyment, and right of disposition. Titles can change hands through a will, court decree, law, or by selling the property. Any time a title is transferred it is recorded in a deed and filed with county clerks.

WHAT IS TITLE INSURANCE?

Having title insurance protects the lender and the buyer from financial loss due to title defects.

WHAT CAN MAKE A TITLE DEFECTIVE?

Many defects can hinder the transfer of a title:

- Fraud

- Unknown

- Heirs

- False affidavits

- Unpaid judgments

- Unfiled liens

- Forged documents

- Improperly indexed documents

- Errors in tax records

DO I NEED TITLE INSURANCE?

Unless you are paying for your home out of pocket, your lender will more than likely require you to purchase title insurance. It's advisable to purchase a policy to protect yourself as well. By doing so, you are protecting yourself from title defects that may give someone else claim to your property.

WHAT DOES TITLE INSURANCE PROTECT YOU AGAINST?

There are many things title insurance protects you against, but some of the most common are:

- Fraud

- Forged deeds, releases or wills

- Misinterpretations of wills

- Deeds by minors or by persons of unsound mind

- Deeds by persons supposedly single, but in fact married

- Liens

- Unpaid taxes

- Unpaid inheritance

HOW DOES TITLE INSURANCE PROTECT YOU?

The insurance policy will pay for any legal defense costs and reimburse you for any mortgage payments you are unable to make due to losing the house to someone else's claim on it.

WHAT IS A TITLE REPORT

The title report is prepared by the title company and discloses any information about easements, restrictions, ownership, and liens on the home.

WHAT IS A SETTLEMENT?

The settlement is another term for "closing." It's the completion of a real estate transaction where the title passes from the seller to the buyer.

WHAT IS CLOSING?

Closing is another term for "settlement." It refers to the part of the real estate transaction where the title moves from the seller to the buyer's hands.

ARE ALL TITLE COMPANIES CLOSING COMPANIES?

Unfortunately, no. Some title companies only sell the insurance and others only work in escrow. Dubois County Title can help you with all of your closing needs.

WILL MY REAL ESTATE AGENT KNOW ANYTHING ABOUT THE TITLE TO THE HOME?

Many real estate agents will have a thorough understanding of what a title is. The nuances of title insurance, and recommend a trusted title company. However, no one will know precisely what information is related to the title until a title search is completed.

HOW MUCH CAN I EXPECT TO PAY FOR TITLE INSURANCE?

Rates vary depending on how much you paid for the home. The policy usually takes up less than 10% of your total closing costs.

WILL I HAVE TO PAY FOR TITLE INSURANCE EVERY MONTH?

No. Title insurance, unlike other insurance policies, is not billed as a monthly premium. It's a one-time cost you pay at the time you purchase your home. The policy lasts for the time you and your heirs own the property.

CAN THE BUYER PICK THE TITLE COMPANY?

Yes. Sellers can require a buyer to purchase title insurance, but they can't dictate which company to use.

- Mon - Fri

- -

- Sat - Sun

- Closed

- Mon - Fri

- -

- Sat - Sun

- Closed

- Mon - Fri

- -

- Sat - Sun

- Closed